Homeowners Insurance in and around Lynden

Protect what's important from catastrophe.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

New home. New adventures. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help insure your home in case of blizzard or fire, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they slipped in your home, the right homeowners insurance may be able to cover the cost.

Protect what's important from catastrophe.

Help protect your home with the right insurance for you.

State Farm Can Cover Your Home, Too

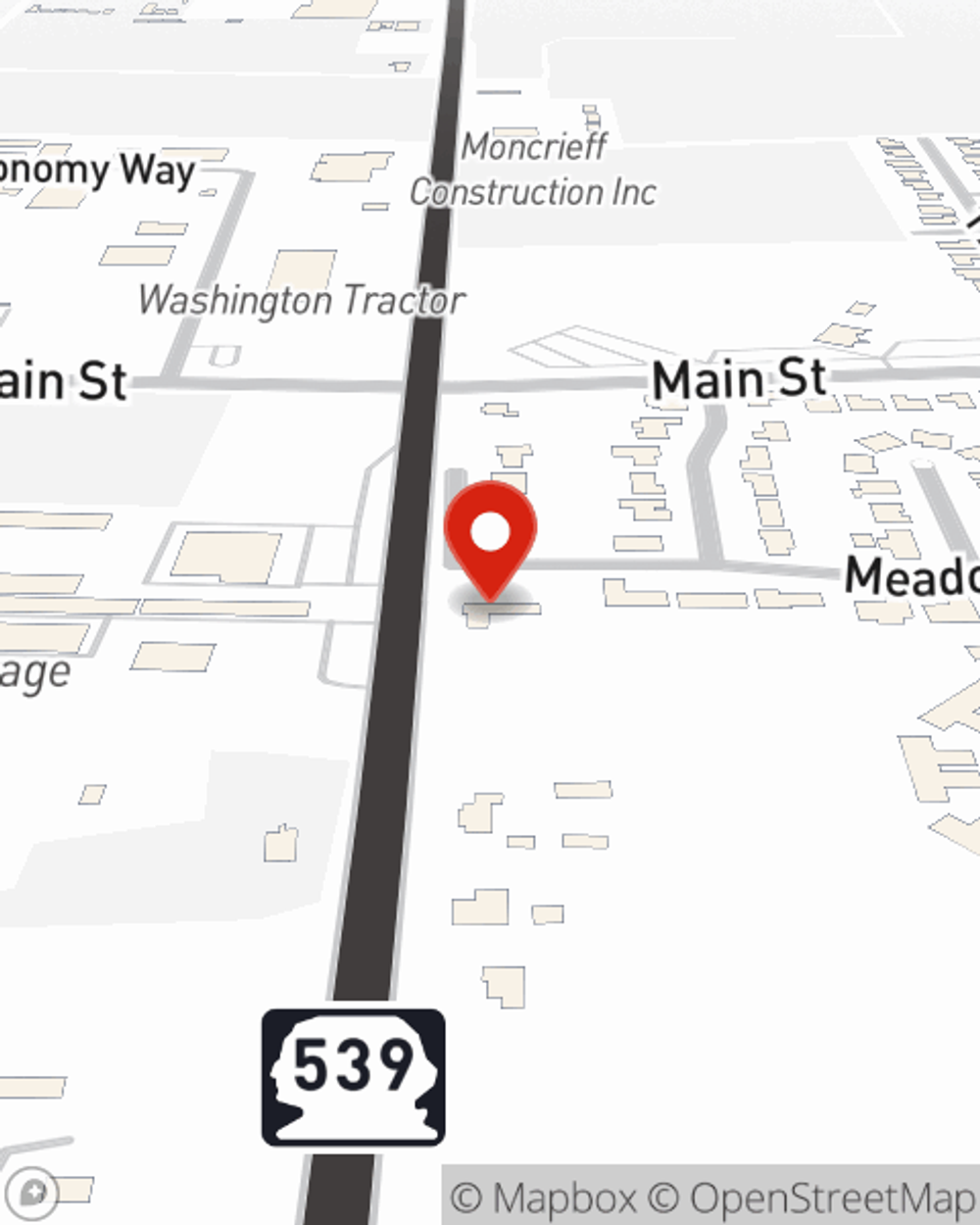

That’s why your friends and neighbors in Lynden turn to State Farm Agent Amy Warenski. Amy Warenski can explain your liabilities and help you make sure your bases are covered.

For terrific protection for your home and your keepsakes, check out the coverage options with State Farm. And if you're ready to get started on a home insurance policy, reach out to State Farm agent Amy Warenski's office today.

Have More Questions About Homeowners Insurance?

Call Amy at (360) 354-6868 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Under sink storage: What not to store under the sink

Under sink storage: What not to store under the sink

Organize the space under the sink to make your home safer and more efficient. Read these helpful ideas that are easy for everyone in your household to follow.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.

Amy Warenski

State Farm® Insurance AgentSimple Insights®

Under sink storage: What not to store under the sink

Under sink storage: What not to store under the sink

Organize the space under the sink to make your home safer and more efficient. Read these helpful ideas that are easy for everyone in your household to follow.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.